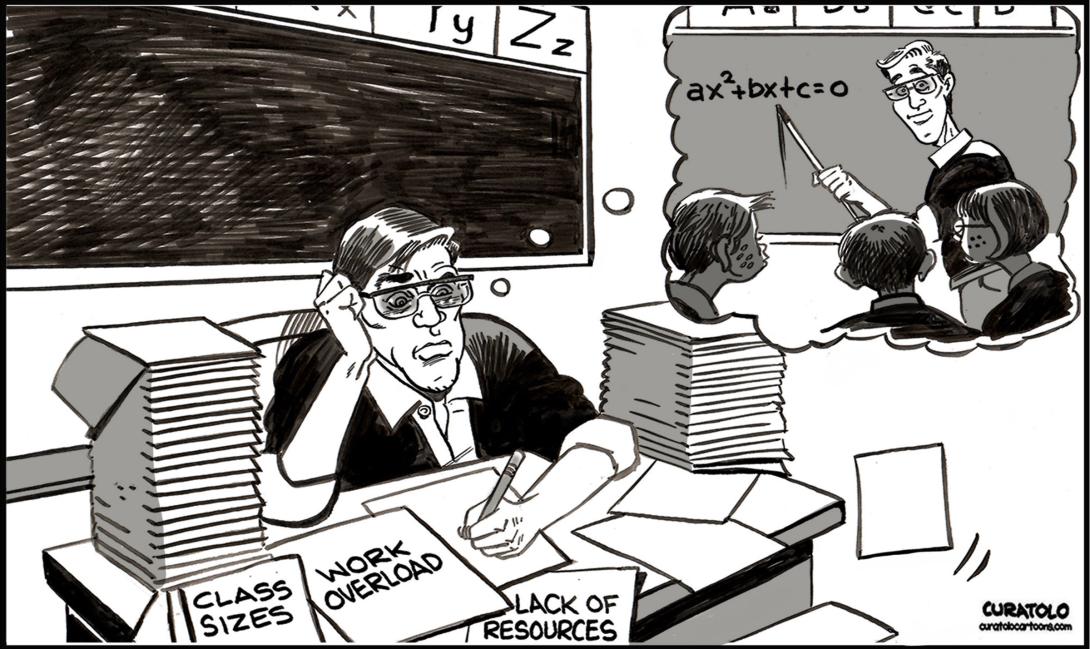

Question: I think I’m about five or 10 years away from retiring, but I’ve decided to quit teaching. Would it make sense for me to pull my pension funds out now?

Answer: It is a hard time to be a teacher, and I understand and respect the decision of some to leave the profession earlier than they might have expected. One aspect of the decision involves how to manage one’s accumulated pension. If you haven’t turned 55 yet, you may be eligible to withdraw the commuted value of your pension as benefit if you terminate your employment contract. Whether this is a smart idea is a different question.

I cannot stress enough the importance of getting good, personalized advice from a knowledgeable, qualified source before making what might well be an irrevocable decision. You should start by speaking to a staff officer with the Association’s Teacher Employment Services and a pension advisor with the Alberta Teachers’ Retirement Fund. These folks have no personal financial interest in whatever decision you eventually make — their job is to ensure that you are equipped to make an informed decision and are fully aware of its consequences.

You may also want to consult with a financial advisor. Selecting one can be a bit challenging as the title is largely unregulated and there is no shortage of individuals offering their services on YouTube, through flyers and online adds or by word of mouth. I suggest that you look to engage a “for-fee” advisor, someone you pay up front to analyse your entire financial situation, help clarify your objectives, and set out some options and strategies for you. They do not stand to gain commissions from selling you financial products or fees for managing your money going forward, and so they are more likely to offer unbiased advice.

As you consider your options, there are some questions you and your advisors will have to consider.

Are you certain you are leaving teaching permanently?

If you are looking to take a break and come back or are not entirely certain what your future may be, leaving your pension in place and deferring a decision would likely be the better option. If you pick up another line of work, you may have the option of transferring your pension accrual to a new plan.

How are you planning to support yourself as you age?

Your teachers’ pension will pay you benefits for the entirety of your life and, even after your death, to your pension partner. If you do not have a pension partner, you can choose to have payments made to your named beneficiaries should you die before a specified guarantee period has ended. This is particularly important as the life span of people currently alive who will be receiving pension benefits is likely to extend well into the 90s.

How able are you to manage market fluctuations and risk?

The teachers’ pension plan is a “defined benefit” plan backed by the plan itself and the Government of Alberta, meaning that the payments made are not subject to the ups and downs of the investment market in an uncertain world. Furthermore, benefits are protected from inflation, with a 70 per cent cost-of-living adjustment for all post 1992 service earned. So if inflation in a year was 10 per cent, your benefit would be automatically increased by seven per cent. The adjustment for all service up to and including 1992 is 60 per cent. Such solid guarantees are virtually impossible for a casual independent investor to obtain for themselves at a reasonable cost.

What are the tax implications of cashing out your pension?

A portion of the commuted value must be transferred directly to a locked in retirement account (LIRA) as per the Alberta Employment Pension Plans Act, and the remaining portion must be paid in cash and is fully taxable in the year it is paid out. This will be a substantial hit that would otherwise be avoided if you were to remain in the plan and receive benefit payments.

Are you facing pressure from debt?

Apart from adding to your problems the tax hit already mentioned, there are better ways to manage debt than by cashing out your pension. The funds in your pension plan are protected in any bankruptcy proceeding; however, once they are paid out, they can be seized by your creditors. There are services, some not-for profit, to help you identify how best to manage your debts and those coming after you for payment.

While there are some unusual circumstances where cashing out a pension makes sense, in most cases this is something that teachers should undertake very reluctantly and with eyes wide open. Again, if you are considering this option, call us first for advice and support.

Questions for consideration in this column are welcome. Please address them to Dennis Theobald at dennis.theobald@ata.ab.ca.

ATA Executive Secretary